It’s the American Dream!

Are You Ready to Buy Your First Home?

It does not seem possible that you are really thinking about this – The American Dream of Owning a Home! How exciting! How many people emigrated to the US just for the privilege and opportunity to have this dream and begin a new life? You have only been out of college and on your own for a few years. You took advantage of getting a good education to prepare yourself for the future you envisioned and lived at home for a little while to save some money. It’s been fun living in your apartment in a mixed-use building with all the spectacular views, conveniences and walkability, but you really want more room for entertaining and that Labradoodle you want and hopefully a family of your own in the future. You have saved a good amount and can actually imagine buying a home of your own.

What you pay for rent isn’t that far off from a mortgage payment. It would be better to invest that in yourself instead of paying rent.But here you are an adult now with a steady and stable job in a good, promising, career field. The future is at your feet and it really is All About You. You love this town, with family nearby and want to put down roots and be a member of the community and the surest way to do that is to buy a house – Isn’t it? This is definitely more than just picking the house and moving in and getting to know your neighbors. There are emotional, practical and financial decisions and issues to consider, so let’s explore these and gain some perspective.

Preparing Yourself to be a Home Owner

Let’s start with the practical aspects such as finances. You need to get credit ready and make sure your finances are in good order. But before you do that, I recommend that you sit down with your parents and ask them how much it really costs to own a home. It is more than just the mortgage payment. There is home insurance to cover incidents such as damages from a fire or flood or natural disasters, repair costs, maintenance costs for the home and large appliances such as heating and air conditioner or water heater, yard care, the monthly costs of water, utilities (Gas and electricity), garbage collection and various fees, taxes and expenses. Many new housing developments require home buyers to also pay a monthly Home Owner’s Association (HOA) fee. This is generally used to take care of community amenities available to all residents such as a swimming pool, playgrounds, landscaping or community center and can add $2-300 per month or more on top of your mortgage payment. Your parents had the roof replaced last year. Where did that money come from? Did they have it saved or did they have to take out a loan to pay for that? There are all kinds of expenses that can arise, so ask the difficult questions and put this into your knowledge base. Get a real education about home ownership.

Getting Your Finances in Order

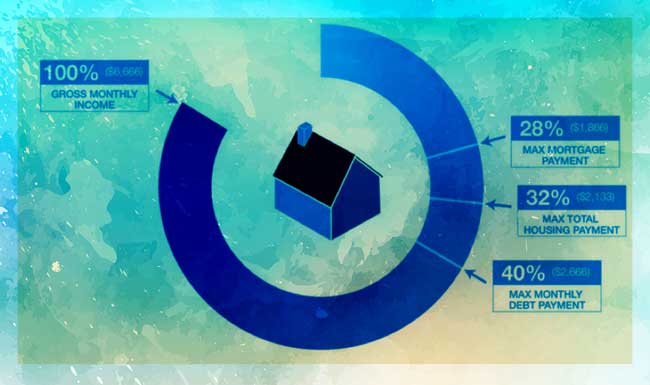

Make sure that you are financially able to afford a home and can qualify for a mortgage. You can do this.

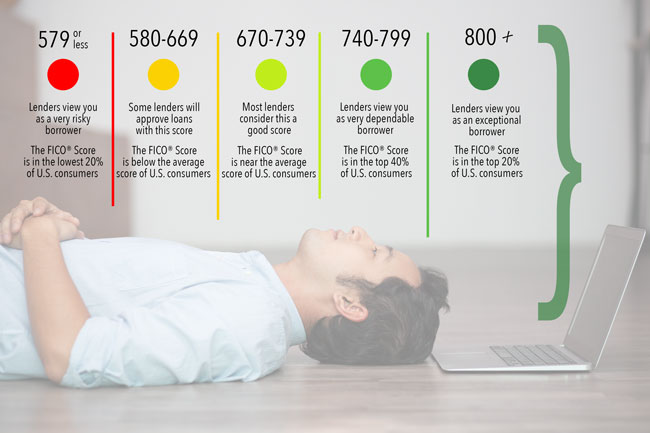

1-Check your Credit Score. Do you know what it is? How often do you check it? Correct errors if there are any. Go to Credit Karma.com. It is free to check your credit score. If you have outstanding balances on credit cards or accounts, start to pay them down and pay them off. Do not apply for new accounts. If you have student loans, be sure you are making the payments on time and as agreed. If you need to improve your score this could take up to six months. Here is a sample credit score chart.

2-Saving Money. If you are not already doing this, start saving money for a down payment which can be up to 20% of the purchase price. It can take time to save this amount of money. Start saving money as soon as you start your first job.

Put a percentage of your salary away before taxes. It is easier to do this automatically from the beginning. If you don’t have the money in hand you will not miss it. Your company may have a financial advisor available to help you decide how much to save.

Also keep in mind that you may need to plan for buying additional furniture or appliances, moving expenses and minor repairs or accessories.

3-Getting Approved. Getting approved for a mortgage before you start looking will save a lot of time and stress. Knowing what you can finance ahead of time makes it easier for you and your real estate agent. Go to Lending Tree and get up to 5 competing mortgage quotes for free. Before you start looking get a pre-qualification letter from one of them to speed things up.

Do your research and learn everything you can before talking to a real estate agent or start looking at properties. Knowledge is Power and we want you to have it. Don’t just run out and start looking at houses before you know your true financial situation. This will set you up for disappointment and heartache. You don’t want to find the house of your dreams only to realize you cannot afford it.