The Dream of Home Ownership

A First Time Home Buyer Loan is the perfect way to get started on your dream of home ownership.

Many of us grew up in nice suburban neighborhoods in single-family homes that our parents bought to raise their families in and build their lives together. These were often community based with amenities such as good schools, shopping, activities, parks and entertainment or at least easy access to those things. Riding our bikes or skateboarding to the local park was easy and we loved the opportunities and friends we made. We took that for granted because that is what we had and we didn’t think about what it took for our parents to give us that lifestyle.

We were just happy to have it. Now we are grown up and have our own lives and while our world has evolved, we may have different ideas for our futures, but the idea of owning our own home someday is still appealing to many. It’s like a badge of honor and coming of age. Why wouldn’t we want our own space with a backyard for entertaining to maybe raise kids and pets or just for ourselves? Times have changed and so have the processes for attaining that dream. It takes more planning than we originally thought. Here are some guidelines to help you understand how to achieve your dream with a first-time home buyer loan.

How to prepare for the loan for your first home?

As soon as you enter the workplace put a savings plan into effect. This should be a percentage of your gross salary (before taxes). Talk to a financial advisor for help and this should also include separate retirement planning. Let’s imagine that you want to buy a home in 5 years. You would need to save $290.82 per month for five years to save $20,000. It is never too early to start. You can find calculators on line for just about any amount. Every time you get a raise, add another percentage point or more. Having it automatically deducted is the smart way to go. You will not miss what you do not have in your hands. This is not money that you can dip into for a new outfit or the latest digital product, this money is growing to achieve a purpose for the future. This is especially true for retirement. Don’t touch these funds. You can set up a separate discretionary savings account for yourself.

Home Ownership and the American Dream

1. What is your dream? This is the idea that you have for a safe, happy life and environment for yourself and/or a family.

2. Your Personal Vision. What does your life look like in this dream? Where is it? Who is in this dream with you, spouse, children, pets? What kind of social life do you envision? Can you afford all of this?

3. Where to Compromise. Keep your vision solid but be willing to compromise on details. How much to spend is firm? How much down payment? Where, when?

4. Describe your Dream. A good real estate agent will help you find what is available in your area, in your budget and requirements. You may decide to wait and save more money in order to achieve home ownership and the American Dream.

5. Stay in your budget? It is easy to be drawn to attractive details that will end up costing you more than you can afford. Do not get distracted. Be practical and do not be tempted by pretty add-ons and unnecessary fixtures. Bigger and brighter, does not mean better.

6. Uncomfortable Moments. There will be lots of decisions to make and not all will be easy. If you are married or have a partner, discuss your budget, finances, monthly spending. Try to agree on what size and type of house you want and where? Be prepared to make compromises to work on how to prepare for your first-time buyer loan.

7. Starter or Forever Home. Many people buy a smaller, more affordable home in the beginning and plan to stay a few years, build some equity, save more money and then sell it and move to a larger ‘American Dream’ home in the future.

A Checklist for First-Time Home Buyers

Are you Mortgage Ready? Here are the Four C’s in Mortgage Readiness.

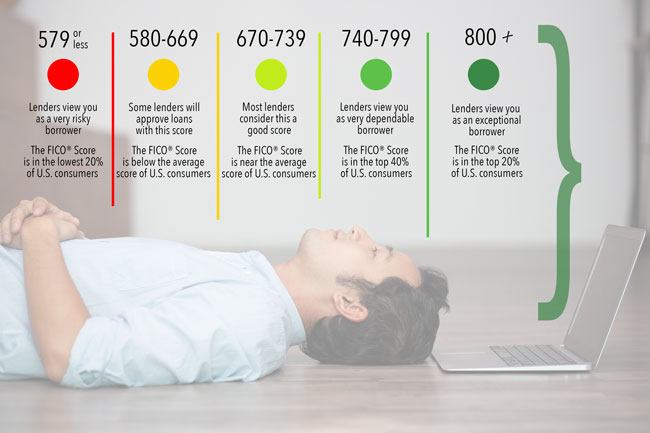

CREDIT: You need to have a good if not great credit score. This is determined by how much debt you currently have and what your payment history is. However, there are many home loan programs to help first time home buyers with a credit score below average. If you pay your bills on time every month and do not spend beyond your means you may be lucky enough to have a high credit score and will be considered a good risk by a mortgage lender. Pay down your balances, do not apply for new credit and make all payments as agreed and correct any errors. If you need to improve your score it could take six months while you work toward your first-time home buyer loan.

What your FICO® Score means to lenders:

Capacity This is your income. How much can you afford for a monthly mortgage payment every month and still be able to handle other expenses and payments, such as car payments and upkeep, groceries, medical bills, utilities, entertainment, clothing, vacations, etc.? You do not want to be ‘house poor’ and not be able to afford to live decently.

Capital How much do you have for a down payment? There are going to be other expenses such as closing costs and fees, property inspections, appraisals, repair estimates and other items as you work toward home ownership. Be patient as the process works. Make sure you have funds to cover these things. The median cost of a starter home in Florida for 2017 was estimated at $229,400 according to Bankrate.com. Prices vary by state. A great resource for basic information for first time home buyers can be found here and other places.

How much cash do you really need to buy a $200k home?

Category | Formula | Total |

Down Payment | 10 % of $200,000 | $20,000.00 |

Closing Costs | 2.5 % of $180,000 | $4,500.00 |

Prepaid Expenses | 2 % of $180,000 | $3,600.00 |

Utility Adjustments | Estimated | $500.00 |

Cash Reserves | $1200.00 Mortgage Payment X 2 | $2,400.00 |

TOTAL CASH REQUIRED | $31,000.00 | |

As you can see, you could need more than 1.5 times your down payment to successfully close your first-time home buyer loan.

Collateral Your real estate agent will work with you to find properties that match your vision within your budget and desired location. Some flexibility may be necessary, but your budget should be firm. The style and type of home may be adjustable. You can do your own research and talk to real estate agents and study the current trends. There is a wealth of information available to help you become a first-time home buyer and achieve Your American Dream.

Programs available and that can apply.

Do you need the Advice of a now?